Before a Broadway show goes out on tour, it will spend weeks in residence at a theater “teching.” That’s building the sets, lighting schemes, props, costumes and other elements that are needed to bring the magic of Broadway on the road.

It’s a moneymaker for theaters, because the Broadway show pays rent to them during tech, and employs in-house stagehands to do much of the work. It’s also a moneymaker for local hotels and restaurants.

“The tech process can take anywhere from two to eight weeks of time, depending on how large the tour is,” said Anthony McDonald, executive director of the Shubert Theater in New Haven. “During that time, 50-plus people will come into our community to build that show. Each individual will receive $1,000-plus in per diem each week, to spend in our local restaurants, local businesses and shops. They create an ecosystem that ... doesn’t presently exist.”

The reason that ecosystem doesn’t exist, said McDonald, is because Broadway shows are choosing to tech their tours in states that offer them a tax credit. Connecticut currently does not offer such a credit.

“In the early 2000s, [the Broadway musical] “Jersey Boys” teched their tours right at the Shubert Theater,” McDonald said. “But after that, New York state adopted tax credits, and they left Connecticut to go there.”

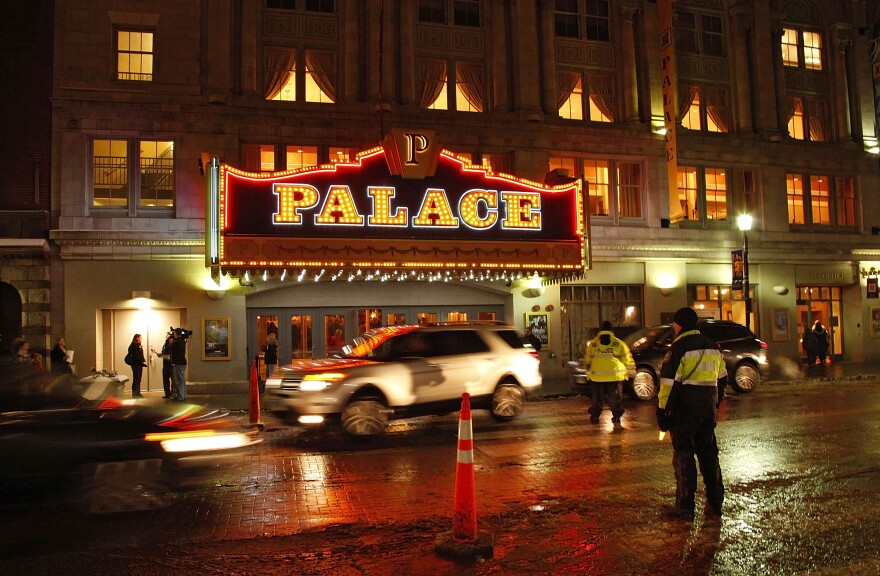

New York, Ohio, Kentucky, Rhode Island and Maryland offer touring companies a tax credit, according to McDonald. Massachusetts Gov. Maura Healey has proposed a similar program in her state. Now the six Connecticut theaters that present Broadway touring shows — The Bushnell in Hartford, the Garde Arts Center in New London, The Palace Stamford, The Palace in Waterbury, Shubert in New Haven, and the Warner Theatre in Torrington — are urging lawmakers to adopt a similar tax credit.

“By approving this bill and providing our industry with theater tax credits, it will allow us to attract a show not just to perform here, but come to the state and build the show,” McDonald said.

House Bill 6919, “An Act Establishing a Tax Credit for Certain Pre-Broadway and Post-Broadway Theater Productions,” would offer a 30% tax credit to companies that tech their Broadway tours in the state. This tax credit would be 5% greater than what New York and Maryland currently offer. The bill is awaiting a vote in the General Assembly’s Finance, Revenue and Bonding Committee.